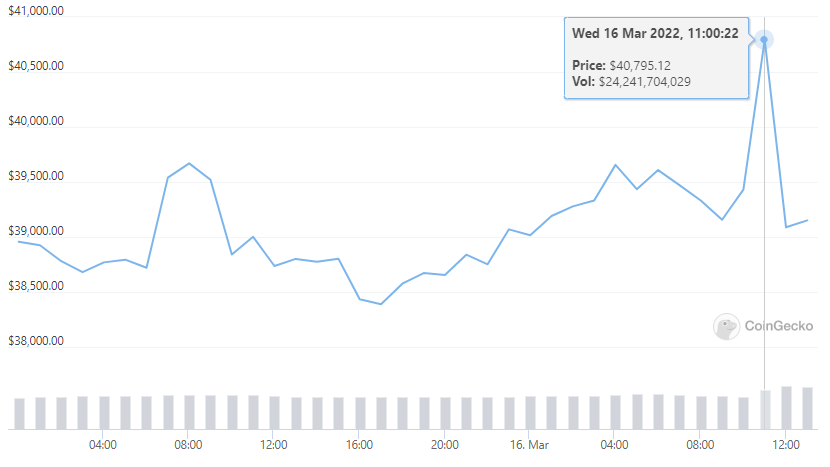

On March 16, BTC rose for a short time and quickly exceeded $41,000, with an intra-day increase of 5.86%, but then fell back below $40,000.

Many Believe That the Next Step for Bitcoin BTC 2.97% Is to Fall

In recent days, the crypto market has been volatile, and market worries have risen. Many voices believe that the next trend of Bitcoin should be a loss, not a profit. At the same time, the market’s worries about possible regulation in the United States have exacerbated the market’s nervousness.

On March 16, Edward Snowden, a former CIA employee, said at the Camp Ethereal 2022 summit that the government sees cryptocurrencies as an “evolving threat.” Snowden said that Ethereum ETH 6.19% has the same privacy issues as Bitcoin, but he still called the Bitcoin blockchain a level playing field, seeing the power of cryptocurrencies and decentralized technologies.

In addition, the U.S. SEC also issued an investor announcement as early as February, to be alert to the risks of interest-bearing accounts of encrypted assets. The announcement mentions that interest-bearing accounts with crypto assets should not be expected to have the same level of security, safety, and soundness as deposits in banks or credit unions. At the same time, crypto assets held in interest-bearing accounts can be used to invest in various products, programs or other activities related to crypto assets, including lending programs that lend crypto assets to borrowers. These investment activities may present risks in a number of ways, including volatility and illiquidity in the cryptoasset market; the risk that the company holding your cryptoasset may fail or go bankrupt; federal, state or foreign governments may restrict the use of the cryptoasset and regulatory changes in exchanges, etc.

Defi Tvl Continues to Decline

The market has cooled down and investment sentiment has continued to decline, and the DeFi TVL of the entire network has also continued to decline. Up to now, the total locked volume of DeFi on the entire network is US$154.4 billion, a decrease of 1.48% from the previous month; a decrease of 29.6% from the historical high of US$219.47 billion (January 19, 2022).

But despite this, long-term investors as well as institutional investors continue to be bullish on the crypto market. Brett Munster of Blockforce Capital said that as long as the price of bitcoin falls, long-term investors will come in.

In addition, Oppenheimer’s equity research analyst Owen Lau also gave a “hidden value” evaluation to companies that continue to invest in the crypto space. In a note to clients, Owen Lau said cryptocurrency exchange Coinbase’s venture capital business is undervalued and has “hidden value” in its Coinbase Ventures unit that investors haven’t fully realized yet.

At the same time, investment in the crypto space continues to grow. Research firm Fundstrat said in its latest report to clients on March 16 that the sector has attracted between $800 million and about $2 billion in weekly investment since the beginning of the year. Venture capital buyers invested around $4 billion in the cryptocurrency space in the last three weeks of February, with data showing that venture capital firms poured another $400 million into startups in the space last week.

U.S. investors pulled a net $7.8 billion from bond funds in the week ended March 9, while global investors are actively investing in crypto, according to data from Lipper, a fund analysis firm owned by Refinitiv. Monetary funds and companies.