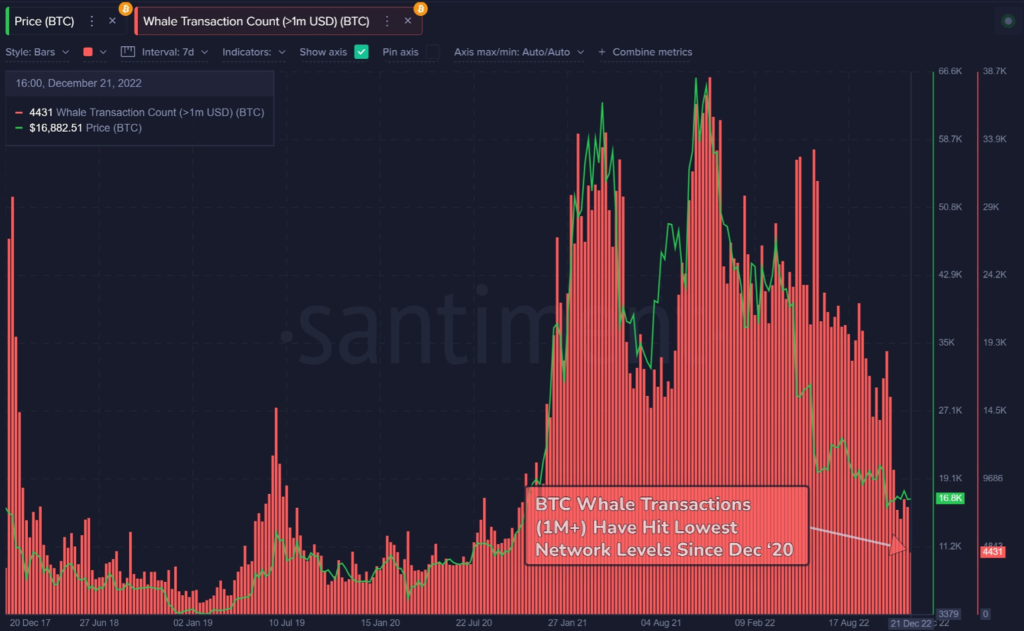

Cryptocurrency analytics firm Santiment has released new data showing a significant drop in the level of “interest” among bitcoin BTC -5.28% whales in recent trading activity.

According to Santiment’s metrics, the number of whales – defined as holders of large amounts of bitcoin – actively participating in trades has hit its lowest level since 2020. This trend is in contrast to the overall growth in bitcoin’s price and market capitalization over the past year.

What Could Be Driving the Decline in Whale Activity?

There are a few possible explanations for the decrease in whale trading activity. One possibility is that these large holders are taking a more long-term approach to their investments, opting to hold onto their bitcoin rather than actively trading it.

Another possibility is that regulatory uncertainty and the potential for stricter rules on cryptocurrency trading may be causing whales to tread cautiously. The US Securities and Exchange Commission (SEC) has recently taken steps to crack down on illegal activity in the crypto market, and this increased scrutiny may be causing some whales to scale back their trading activity.

Is This a Cause for Concern?

It’s important to note that the drop in whale activity does not necessarily indicate a lack of confidence in the future of bitcoin. These large holders may simply be adopting a more passive investment strategy, or they may be taking a wait-and-see approach to see how regulatory developments play out.

Additionally, the overall growth in bitcoin’s price and market capitalization shows that there is still strong demand for the cryptocurrency. It’s possible that the decrease in whale activity could simply be a temporary dip, and that these large holders will return to trading at a later date.

What Does the Future Hold for Bitcoin?

It’s difficult to predict exactly what the future holds for bitcoin and the wider cryptocurrency market. However, the recent drop in whale activity is certainly something to keep an eye on, as these large holders can have a significant impact on market dynamics.

Overall, it’s important for investors to keep a long-term perspective and to stay informed about developments in the market. While the decrease in whale activity may be cause for some concern, it’s important to remember that the crypto market is still in its early stages and is likely to experience a range of ups and downs along the way.