As the originator of cryptocurrencies, the total amount of Bitcoin BTC -0.88% is capped at 21 million.

Up to now, the number of bitcoins mined in the world has reached as much as 83% of the total. It is estimated that by 2040, more than 99% of Bitcoin will be mined. The question is, what happens when all bitcoins are mined? As we all know, “digital gold” Bitcoin is a deflationary virtual currency. Subject to the fixed circulation of 21 million set in advance by the creator Satoshi Nakamoto, Bitcoin is destined to be unable to print and issue unlimited money like the US dollar, British pound and other legal currencies.

The scarcity of Bitcoin can propel it to ever-increasing value. But at the same time, when all bitcoins are mined, those miners who maintain the bitcoin network will no longer be able to receive block rewards, which also raises a series of questions:

- What happens after all bitcoins are mined?

- What will miners do after reaching the 21 million supply cap?

- How will miners make a living in the future?

- What incentives are there for miners to continue to maintain the security of the Bitcoin network?

In fact, the answer is very simple. It can be said that the life of miners lies in transaction fees.

What happens when all Bitcoins are mined?

Every time a new block is mined, the miner will get a certain reward, including the block reward and transaction fee reward for newly mined bitcoins.

These two rewards incentivize miners to do the right thing and secure the Bitcoin network. Once all bitcoins are mined, miners will no longer be able to receive block rewards, and their only source of income will be transaction fees. Will they make ends meet? If the number of miners is drastically reduced due to sharply reduced income levels, will this eventually lead to the collapse of the Bitcoin network?

The answer is negative.

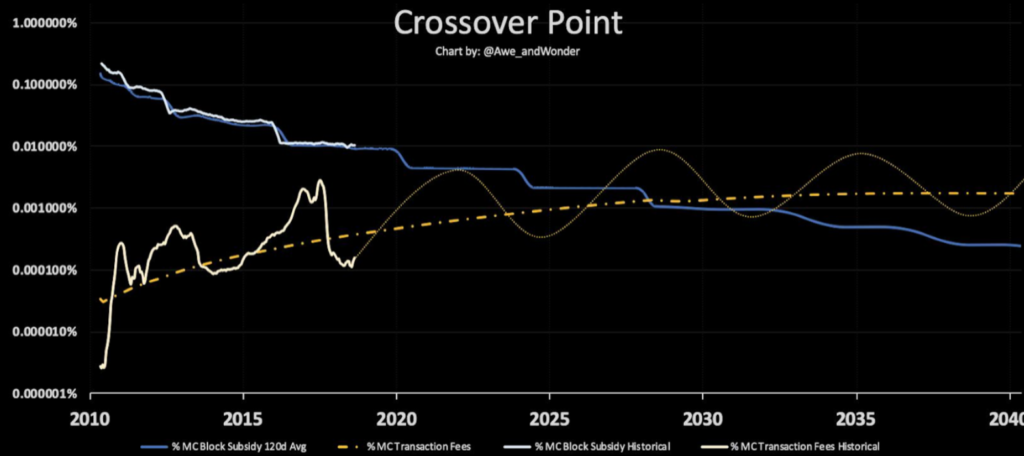

As shown in the chart below, research by crypto asset management platform Interchange and cryptocurrency analyst Awe & Wonder found that Bitcoin transaction fees are on the rise. By 2030, Bitcoin transaction fees will exceed block rewards. Once transaction fees account for more than 50% of the rewards miners receive, then miners can transition to a model where they make money from transaction fees.

The transaction fee will become the miner’s income after all is mined

Although no one dared to bet, there is ample evidence that transaction fees are sufficient to keep miners afloat and maintain the stability of the Bitcoin network. After all, as Bitcoin’s value increases day by day, so will the transaction fees miners receive.

But some people have also raised the question, whether the transaction fee is too high to make users stay away from Bitcoin? In fact, Bitcoin transaction fees are much lower than those incurred for bank transfers, house purchases, etc.

“The transaction fee for real estate is 2% of the average transaction price or $8,000 per transaction. I believe that in the future people will be more willing to pay $50 to pay for transactions through crypto assets, after all crypto assets are not easily lost, damaged or stolen. Stealing, and property is at risk when times are turbulent.”

Interchange

In the future, transaction fees will account for a higher and higher proportion of miners’ income sources, and as the price of BTC gradually climbs, transaction fees will also rise.

In view of this, it is economically feasible to use transaction fees to incentivize miners to continue maintaining the stability of the Bitcoin network. For Bitcoin miners, their revenue stream will not change from relying on block rewards to relying on transaction fees overnight.

The future is full of variables, but there is undoubtedly enough time for miners to adapt to the new model to jointly maintain the security of the Bitcoin network.

Interestingly, Alex Sunnarborg, co-founder of cryptocurrency hedge fund Tetras Capital, previously noted: “In a non-inflationary environment, only Bitcoin and Ethereum ETH -1.20% generate enough transaction fees to cover miners’ losses.”