During the week Bitcoin faced a decrease, in its value particularly on April 12 and 13 leading to significant effects across the cryptocurrency market.

Altcoin News

The cryptocurrency market has made a comeback surpassing the $2 trillion mark more a milestone not seen since April 2022.

On February 20th Bitcoin experienced a drop decreasing by 4% from its peak of $53,019 to a low of $50,812 within the day.

During a week filled with ups and downs, in the cryptocurrency market the WLD token from Worldcoin stood out by skyrocketing a 142.7% against the U.S. Dollar.

Celsius Network has successfully emerged from Chapter 11 bankruptcy marking a milestone in its journey.

The cryptocurrency market, always a hotbed of discussion and speculation, currently finds itself on the cusp of a potentially lucrative period known as altcoin season.

It seems that all applications, for spot ETFs may have been denied. The cryptocurrency market faced a drop yesterday with Bitcoin plummeting to around $40,000 and several altcoins experiencing greater declines.

Ethereum is witnessing an increase, in transaction activity, which suggests the potential for its price to surpass $2,500.

The recent downturn, in the price of Bitcoin has been accompanied by a decline over the 24 hours.

Solanas (SOL) surge, in value reaching a milestone by surpassing $100 per coin signifies an impressive turnaround for this cryptocurrency.

Ethereum’s recent 4% rise to $2,358 reflects its growing dominance in the cryptocurrency market, overshadowing Bitcoin with stronger investor interest and promising technical indicators.

Bitcoin’s recent performance showcases its strength in the market, balancing between consolidation and resistance levels, as it continues to dominate the cryptocurrency arena.

Amidst an optimistic market trend, Bitcoin and Ethereum demonstrate significant recovery, with broader gains observed across various altcoins, highlighting renewed investor confidence.

Ethereum (ETH) has been exhibiting a bullish pattern, reaching a peak value of $2,041 on November 20, 2023. As the second-largest cryptocurrency by market capitalization, Ethereum’s market cap has climbed to $242.34 billion, with a 24-hour trading volume of $12.07 billion.

In a striking deviation from global trends, South Korean cryptocurrency investors are demonstrating a marked preference for altcoins and locally developed tokens over major cryptocurrencies like Bitcoin and Ethereum.

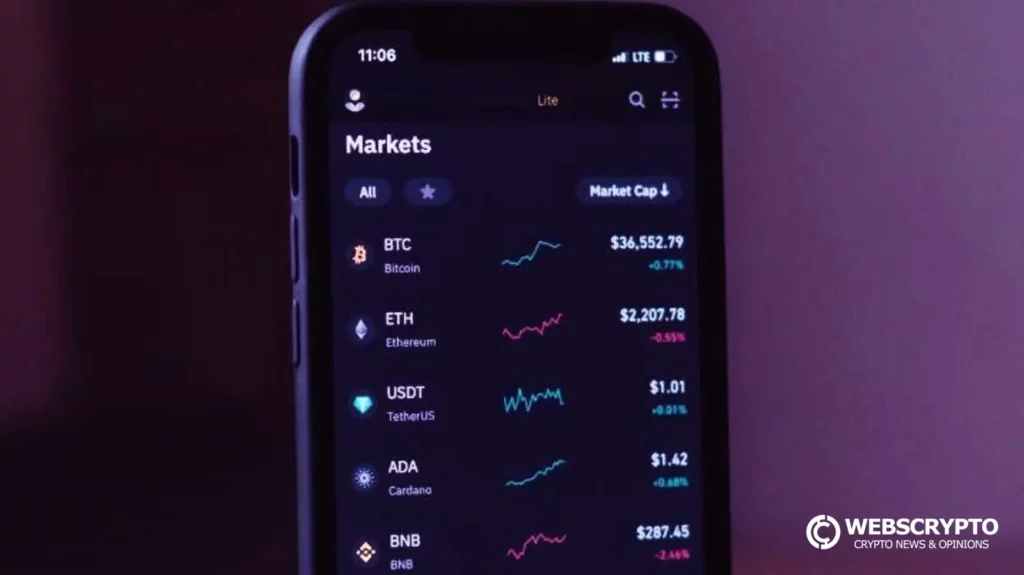

The cryptocurrency market has witnessed significant shifts, with Bitcoin (BTC) emerging as the dominant player.

In a week marked by significant fluctuations in various financial markets, the Standard & Poor’s 500 Index recorded a modest rise of 0.45%, marking its second consecutive week of gains.

Bitcoin, the pioneering cryptocurrency, has recently seen its market dominance rise to 50%, marking a significant shift in the digital asset landscape.

As the final quarter of 2023 approaches, the cryptocurrency market is rife with speculation and predictions.

Ethereum’s scalability has been a topic of discussion for years, and solutions to this challenge have been eagerly anticipated.

Rui, the investment manager of HashKey Capital, tweeted that as Bitcoin fell from $29,000 to $25,000, the market finally came out of the shock range.

The cryptocurrency analysis platform CCData released the “Stablecoins and CBDC Report”, showing that the total market value of stablecoins continued to decline in August.

According to burn tracker Shibburn, the total number of tokens burned in the 24-hour period increased by 64.77% from the previous day.

Delphi Digital published an article stating that MakerDAO recently increased the DAI savings rate to 8%, and this expansion has had a significant financial impact.

According to The Block, the total stablecoin supply has been declining since mid-2022.

Ethena Labs founder Guy Young said that stablecoins need to focus on liquidity, not decentralization.

David Wells, CEO of Enclave Markets, said that PayPal announced the launch of the stablecoin PYUSD, and it is unclear what direct impact it will have on USDC.

According to Messari’s report, Cardano’s average daily dapp transaction volume increased for the third consecutive quarter, and Dapp usage in the second quarter increased by 49.0% quarter-on-quarter, and the average daily transaction volume remained at 57,900.